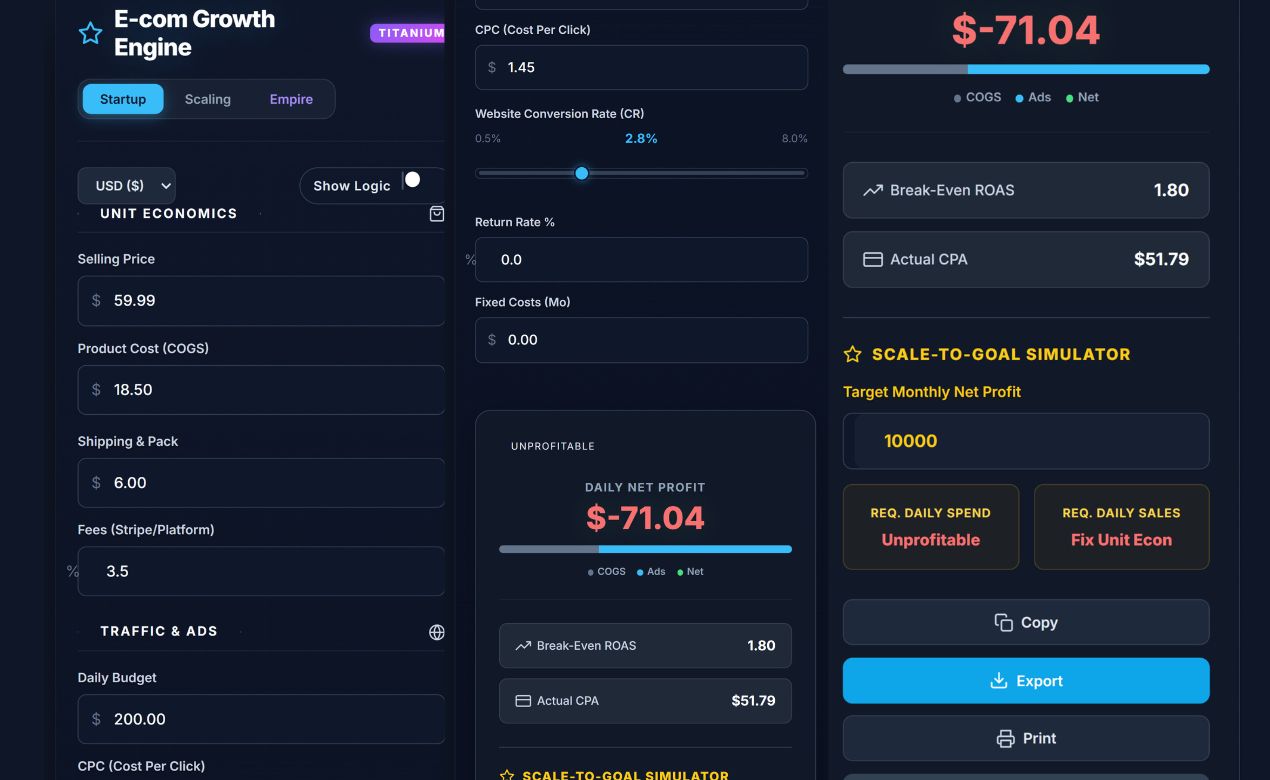

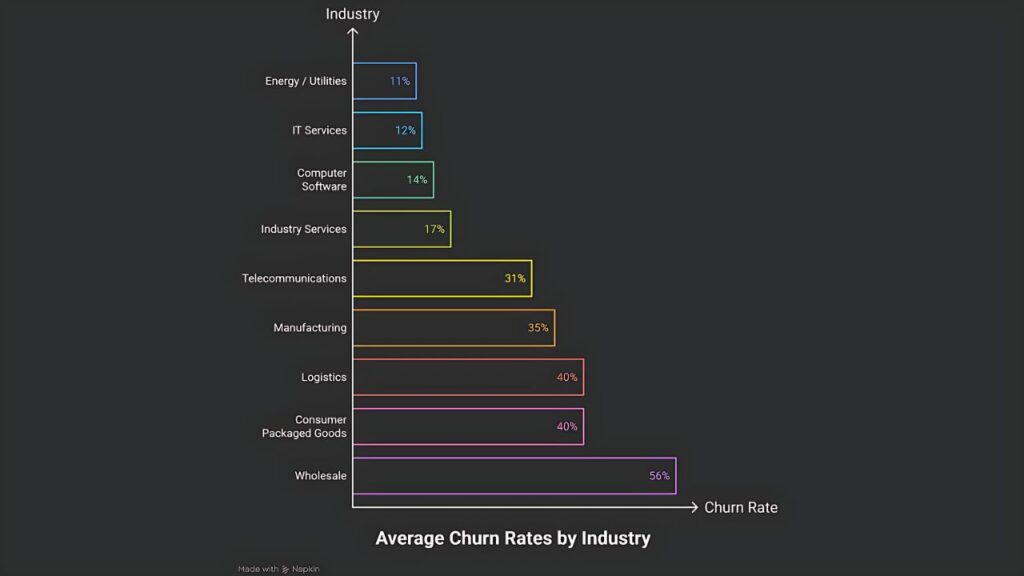

You can lower customer churn by using predictive analytics. This helps you find customers who may leave. Many industries have high churn rates. Logistics and consumer packaged goods both reach 40%. The table below shows average churn rates in big industries:

| Industry | Average Churn Rate |

|---|---|

| Energy / Utilities | 11% |

| IT Services | 12% |

| Computer Software | 14% |

| Industry Services | 17% |

| Telecommunications | 31% |

| Manufacturing | 35% |

| Logistics | 40% |

| Consumer Packaged Goods | 40% |

| Wholesale | 56% |

Predictive Analytics for Customer Retention changes your plan. You stop churn before it starts. Recent studies show you can keep more customers. Retention rates can go up by 15%. You can lose less from attrition, up to 20%. You get the chance to keep customers and grow your business.

Key Takeaways

- Use predictive analytics to find customers who might leave soon. This helps you act before they go, so more people stay.

- Start retention strategies early. Talk to customers who seem less interested. Give them special help or rewards.

- Check your customer churn rate often. Knowing how many leave shows if your strategies work.

- Collect data from many places and put it together. This gives you a full picture of what customers do. It helps you guess who might leave.

- Make customer service better to keep loyalty strong. Fast and kind help makes customers feel important. They are less likely to leave.

Predictive Analytics for Customer Retention

Identify At-Risk Customers

Predictive Analytics for Customer Retention helps you find customers who might leave soon. This method uses lots of data. You should look at how much customers spend and how often they use your business. Watch for any changes in their actions. Usage data and how much they interact can show who is at risk. If you see new payment patterns or changes after trying to keep them, you can act fast.

Telecommunications companies check calls, data use, and payment history to guess who may leave. You can do this in your business too. Look for low use or bad feedback in support tickets and reviews. If customer lifetime value drops, it could mean a problem. Here is a table with signs that help you spot at-risk customers:

| Indicator | Description |

|---|---|

| NPS Survey Results | Detractor or neutral scores show a need for action. |

| Online Community Activity | Low activity can mean dissatisfaction. |

| Support Ticket Data | More support tickets may point to problems. |

| Negative Reviews and Complaints | Direct feedback highlights issues. |

| Contract Change Conversations | Talks about changing contracts may show a lack of commitment. |

| Website Activity | Less activity suggests disengagement. |

| Organizational Changes | Changes in the customer’s company can affect loyalty. |

Enable Proactive Retention

Predictive Analytics for Customer Retention lets you act before customers leave. When you see bad trends in how customers act, you can reach out early. AI algorithms help you spot churn signs, so you can make special plans for each customer. You might give special deals or fix problems before they get bigger.

Here are some ways to keep customers with proactive retention:

- Find at-risk customers early and help them.

- Make offers that fit each customer’s behavior.

- Fix problems before they grow.

- Make the customer journey better to keep them happy.

- Use customer lifetime value to focus on your best customers.

You can also watch engagement scores and set up alerts for your team. If a top customer seems less interested, your team can act fast. These steps help you keep more customers and help your business grow.

Amazon Customer Retention Strategy: How the World’s Most Loyal Brand Uses AI to Keep Customers Coming Back

Amazon Customer Retention Strategy uses AI and data to boost loyalty, personalize experiences, and keep customers coming back.

Calculate and Analyze Churn Rate

Measure Customer Churn

You need to check how many customers leave your business. This helps you know if your plans to keep customers work. To find churn, use a simple formula. Divide lost customers by the number you had at the start. Then multiply by 100 to get a percent. Here is the formula:

| Formula | Description |

|---|---|

| Churn Rate = (Lost Customers / Total Customers at start of period) x 100 | Shows the percentage of customers lost in a given period |

If you have a subscription business, use this formula each month or quarter. In e-commerce, look at groups called cohorts. A cohort is customers who bought for the first time in the same period. Check if these customers come back to buy again. This helps you see churn patterns. You can also use other ways to measure churn. Try engagement scoring, sentiment analysis, and payment tracking. Here is a table with some good methods:

| Method | Description | Example |

|---|---|---|

| Predictive Analytics | Uses algorithms to predict churn based on customer behavior and attributes. | A telecom company predicted 85% of churners two months before cancellation. |

| Sentiment Analysis | Analyzes feedback to gauge satisfaction and predict churn risk. | Negative phrases in chat logs linked to a 70% higher chance of churn. |

| Engagement Scoring | Measures interaction to assess health and predict churn. | A tool flagged customers with a 40% drop in engagement score. |

| Payment and Billing Indicators | Tracks financial behaviors that may indicate churn. | Failed payments made customers 5x more likely to cancel. |

Stop Leaving Clicks on the Table: How to Master Ecommerce Meta Tags in Seconds

Boost your product visibility with optimized Ecommerce Meta Tags. Generate meta titles, descriptions, and rich snippets in seconds — no coding needed..

Assess Churn Impact

You should also look at how churn affects your business. High churn can lower your money and slow growth. If you spot churn early, you can talk to customers before they leave. Checking churn often helps you keep up with what customers want. Here are some reasons to check churn a lot:

- Early checks help you reach at-risk customers.

- Checking often keeps you in tune with customers.

- Ongoing checks give you ideas for better choices.

When you use Predictive Analytics for Customer Retention, you can see trends and act fast. You can split churn by customer groups or by when they joined. This shows if churn is a problem for all or just some groups. By watching these patterns, you can focus where it matters most.

Integrate and Prepare Data

Gather Data from Multiple Sources

You need to get data from many places. Each place gives you a new look at your customers. When you put these together, you see more about them. In retail, you can use things like purchase history and engagement metrics. You can also use support tickets and loyalty program activity. These help you find patterns that show who might leave.

Here is a table that lists important data sources for churn prediction in retail:

| Data Source | Description |

|---|---|

| Purchase History | Looks at how often and how much people buy to spot those who may stop shopping. |

| Engagement Metrics | Watches website visits, email opens, and social media to see if customers are interested. |

| Customer Complaints & Support Tickets | Checks how often people complain and how fast you fix problems to find unhappy customers. |

| Loyalty Program Participation | Sees how often people use rewards to measure loyalty. |

You should get this data from your CRM, website analytics, and customer service tools. When you put all this information together, Predictive Analytics for Customer Retention can find at-risk customers faster.

Ensure Data Quality

Good data helps you make better predictions. You need to check your data to make sure it is right and complete. If your data has mistakes or missing parts, your churn model will not work well. Start by cleaning your data and fixing any errors. Take out repeats and fill in missing spots. Handle strange numbers and make sure everything matches in all systems.

Best ways to keep data good include:

| Best Practice | Description |

|---|---|

| Data Assessment | Check if your data is complete, correct, and matches so you can trust the results. |

| Model Selection | Pick the best model and test it with new data to make sure it works. |

| Interpretability | Make sure you can understand your models, especially if there are rules to follow. |

| Continuous Monitoring | Keep updating your models with new data so they stay correct. |

You should also:

- Spend time cleaning your data and picking the right features.

- Fix missing values and set up categories the right way.

- Check how your model works often and update it with new data.

Tip: Good data is very important for any predictive modeling project. If you keep your data clean and correct, your predictions will be much better.

Build a Churn Prediction Model

Train the Model with Historical Data

You need to teach your churn prediction model using old data. This helps the model learn what makes customers leave. Most companies use three to six months of customer data. The amount you need depends on your business and how often customers visit.

| Historical Data Duration | Industry Dependency |

|---|---|

| 3 months | Varies |

| 6 months | Varies |

There are many machine learning algorithms you can use. Some popular ones are:

- K-nearest neighbors (KNN)

- Gradient Boosting Classifier

- Logistic Regression

- Support Vector Machines (SVM)

- Random Forests

- Neural Networks

Pick the algorithm that works best for your data. Try out different models and see which one does better. Make sure your data is neat and ready before you start. This helps your model find real churn risks.

Interpret Churn Risk Scores

After training, your model gives churn risk scores for each customer. These scores tell you how likely someone is to leave. You need to check if your model is correct. Use different metrics to see how well your model works.

| Metric | Description |

|---|---|

| Recall | Shows how many real churners your model finds. High recall means you catch most at-risk customers. |

| F1 Score | Balances precision and recall. It is good when you care about both mistakes and misses. |

| AUC-ROC | Tells how well your model tells churners from non-churners. A score near 1 means your model is strong. |

| Confusion Matrix | Breaks down predictions into true and false positives and negatives. |

These metrics help you know if your model finds the right customers. If your scores are low, you might need to change your model or add more data. Predictive Analytics for Customer Retention lets you find problems early and make your retention plans better.

How AI-Powered Customer Loyalty Programs Are Changing the Game

Discover how AI-Powered customer loyalty with personalization, predictive analytics, gamification, and real-time engagement.

Segment and Prioritize Customers

Segment by Churn Risk

You can use Predictive Analytics for Customer Retention to group your customers by their risk of leaving. This process helps you see which customers need attention first. You can use different tools and models to do this job well:

- Logistic regression works for both simple and complex data. It gives you results you can understand.

- Decision trees help you see how different factors lead to churn. They are easy to read but need careful tuning.

- Random forests combine many decision trees. This method improves accuracy and avoids mistakes from overfitting.

- Predictive models use machine learning to find patterns in your customer data.

- Customer health scoring systems take many churn signals and turn them into one score.

- Behavior-based segmentation tools group customers by how they act and their risk level.

You can also set up automated alerts. These alerts tell you when a customer’s risk score gets too high. Dynamic dashboards show you risk levels and churn patterns in real time. This makes it easier to decide what to do next.

Tip: Segmenting by churn risk lets you focus your efforts where they matter most.

Prioritize High-Risk Accounts

After you segment your customers, you need to decide which accounts to help first. Start with those who have the highest risk and the most value to your business. Here are some ways to choose:

- Look at the customer health score. This score warns you early when a customer may leave.

- Check customer lifetime value (CLV). Customers with high CLV bring in more money over time.

- Use Net Promoter Score (NPS) to see who is happy and who is not.

- Think about revenue potential. Some accounts can grow with upselling or cross-selling.

- Consider strategic value. Some customers have influence in your market or fit your key products.

- Focus on accounts with a high risk of churn. These need fast action to keep them.

When you use these steps, you make sure your team spends time on the customers who matter most. This approach helps you keep more customers and grow your business.

Actionable Retention Strategies

Personalized Onboarding

Giving customers a good start helps them stay longer. When customers see your product’s value early, they want to keep using it. You can make onboarding better by using different strategies.

| Strategy | Description |

|---|---|

| Analyze User Behavior | Watch how your best customers use your product. Make onboarding steps that fit these habits. |

| Define Success Metrics | Decide what success means for each customer type. Check their progress at every step. |

| Use Welcome Surveys | Ask new customers about their needs. Use answers to make a special experience. |

Quick tutorials help customers learn fast. Motivosity used short lessons called “Quick Win.” Customers met their goals 40% faster and felt happier. Helping customers win early makes them less likely to leave.

Tip: A strong onboarding process builds trust and shows you care about your customers’ success.

Proactive Engagement

You can keep more customers if you reach out before problems start. Proactive engagement means you do not wait for customers to ask for help. Instead, you check in, offer help, and answer questions early. This makes customers feel important and builds strong relationships.

- Proactive engagement can raise customer happiness by 20%.

- Companies using this see a 15% jump in retention.

- Most customers who say their experience is “very good” will tell others and buy again.

- Regular check-ins and personal help make customers feel close to your business.

Predictive Analytics for Customer Retention helps you know when a customer might need help. Set alerts for your team. If a customer’s engagement drops, reach out with tips or support. This keeps customers happy and loyal.

Targeted Offers

You can keep at-risk customers by sending them special offers. These offers make customers feel noticed and valued. You can give discounts, deals, or rewards to customers who may leave.

| Strategy | Description | Key Actions |

|---|---|---|

| Offer Incentives | Give special deals, discounts, or loyalty perks to keep customers. | Send special offers and discounts. |

- Make your messages personal. Send emails with offers that match what each customer likes.

- Use data to pick the best time to send an offer.

- Make sure your offers are timely and fit the customer.

When you use targeted offers, you show customers you understand them. This makes them more likely to stay.

Enhance Customer Service

You can lower churn by making your customer service better. Customers want quick, friendly, and helpful support. When you give them what they need, they want to stay.

- Make onboarding better so customers feel sure from the start.

- Give help before problems get big.

- Make every talk personal. Use the customer’s name and remember what they like.

- Build a group around your product. Let customers share tips and stories.

- Remind customers often why your product is good.

- Give top customers their own account managers.

Better customer service keeps customers happy. When you listen and fix problems fast, customers trust you. These steps make it less likely they will leave for another company.

Note: Great customer service is one of the best ways to keep customers loyal and reduce churn.

Measure and Optimize Results

Track Retention Metrics

You need to watch the right numbers to see if your plans work. These numbers tell you how well you keep customers and where you can do better. Start by checking these important indicators:

- Customer retention rate (CRR) shows how many customers stay with you.

- Customer churn rate (CCR) tells you how many customers leave.

- Repeat purchase rate (RPR) measures how often customers buy again.

- Customer lifetime value (CLV) estimates how much money a customer brings.

- Net promoter score (NPS) shows how likely customers are to recommend you.

- Customer effort score (CES) tells how easy it is for customers to get help.

- Average order value (AOV) shows the average amount spent per order.

- Customer satisfaction score (CSAT) measures how happy customers feel.

You should check these numbers often. Most companies look at them every month. Some numbers, like product use, need daily or weekly checks. This helps you find problems early and fix them fast.

Tip: Use dashboards to watch these numbers all the time. Quick action keeps your customers happy.

Iterate Strategies

You can make your plans better by learning from your data. Predictive analytics helps you find patterns and try new ideas. Use an iterative process to keep improving:

| Iterative Process | Description |

|---|---|

| Identifying turnover patterns | Look at old data to find why customers leave. |

| Flagging at-risk customers | Use models to spot customers who may leave soon. |

| Turning insights into action | Change your plans based on what the data shows. |

| Building a proactive, data-driven culture | Make data part of every choice you make. |

| Strengthening team data skills | Teach your team to use data well. |

| Making data literacy a leadership priority | Help leaders understand and use key numbers. |

| Fostering evidence-based decisions | Use facts, not guesses, to guide your actions. |

| Emphasizing adaptability | Keep changing your plans as you learn more. |

Try new ideas, measure what happens, and change your plans. This cycle helps you keep more customers and grow your business.

Overcome Common Challenges

Data Integration Issues

You might have problems when you try to put data together for churn prediction. Data can come from many places and look different each time. Some data is not organized, so it is hard to mix. You may find mistakes or formats that do not match, which slows you down. Sometimes, you must take out personal details to follow privacy rules. This makes your job longer. Big sets of data are hard to make the same, and putting them into your CRM or ERP system is not simple. You also need to keep cleaning and updating your data as your company grows. Here are some common problems:

- Data comes from many messy places.

- Bad data quality and formats that do not match.

- You must remove personal info to follow the rules.

- Big, mixed data sets are hard to make the same.

- Putting data into old systems is tough.

- You must keep fixing and updating your data.

Tip: Make a clear plan for cleaning data and use tools that help you put data together from different places.

Privacy and Ethics

You have to keep your customers’ data safe when you use it. Sometimes, companies take data without telling people. This can make customers lose trust. You need to protect data and let only the right people see it. Using data for other things, like selling it, can worry people. You should let customers see, change, or erase their data if they want. Check your data often to find bias and keep it fair. Think about these things:

- Collecting data can hurt privacy rights.

- Mixing data can show private details.

- Using data for new things needs clear rules.

Note: Always follow privacy laws and tell customers how you use their data.

Team Alignment

Your whole team needs to work together to stop churn. Data scientists and business experts should share what they know. This helps your models fit what customers really need. You can make one place for all customer data. This lets everyone see the same things and find churn patterns. If you automate your work, your team can act fast and do the most important jobs.

| Strategy | Description |

|---|---|

| Integrating Data Silos for Comprehensive Customer Visibility | Bring together customer data from all parts of your company for a full view and better churn spotting. |

| Blending Business Domain Expertise with Data Science | Mix business and technical skills to make models that work in real life. |

| Scaling Predictive Churn Programs Enterprise-Wide | Automate work so your team can move quickly and focus on big tasks. |

Remember: When your team works together, you can find churn early and keep more customers.

Predictive analytics lets you keep more customers and help your business grow. You can get real results, like making more money and having loyal customers. The table below shows what some companies have done:

| Benefit | Description |

|---|---|

| Increased Revenue | Starbucks made 40% more money from loyalty members by giving special rewards. |

| Enhanced Customer Loyalty | Loyal customers are five times more likely to buy again and four times more likely to tell friends. |

| Effective Targeting of Offers | You can find customers who might leave and send them the right offers. |

Start your program with these steps: First, figure out your customer churn rate. Next, bring all your data together. Then, make a churn prediction model. After that, check your churn risk score. Group your customers by their risk. Use a cloud data platform.

Keep making your plan better. Use predictive analytics tools with your CRM. Check your results and change your strategies if needed. Always be clear about how you use data and let customers have control. This helps you build trust and succeed for a long time.

FAQ

What is customer churn?

Customer churn means customers stop using your product or service. You can measure churn by counting how many customers leave during a set time. High churn can hurt your business growth.

How does predictive analytics help reduce churn?

Predictive analytics uses data to find customers who may leave. You can act early to keep them. This helps you save money and grow your business.

What data do you need for churn prediction?

You need data like purchase history, website visits, support tickets, and feedback. You can use this information to spot patterns and find at-risk customers.

Can small businesses use predictive analytics for churn?

Yes! Many tools work for small businesses. You can start with simple data and grow as you learn. Even basic steps can help you keep more customers.

Muhammad Talha breaks down complex AI tools into simple, step-by-step guides for e-commerce entrepreneurs. His goal: to help you work smarter, not harder, by leveraging artificial intelligence