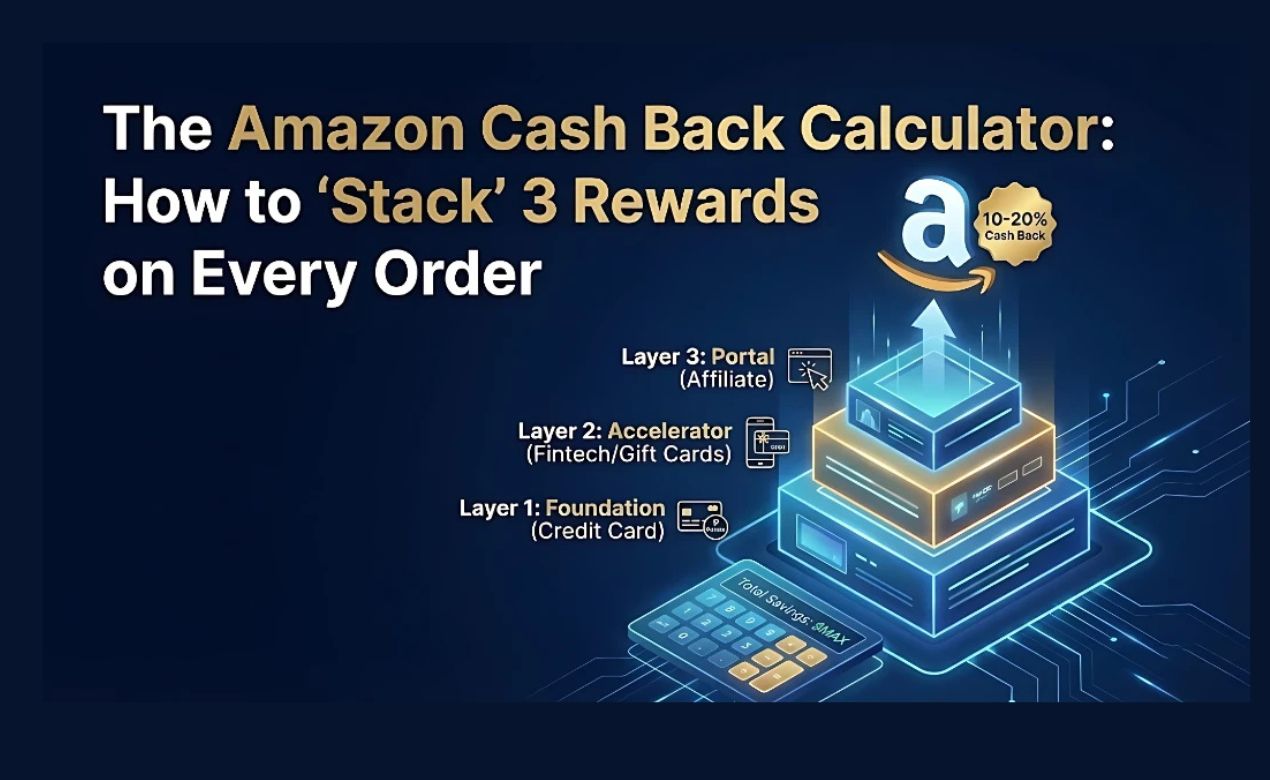

Most Amazon shoppers believe the 5% cash back from the Prime Visa card is the “ceiling” of savings. They are wrong.

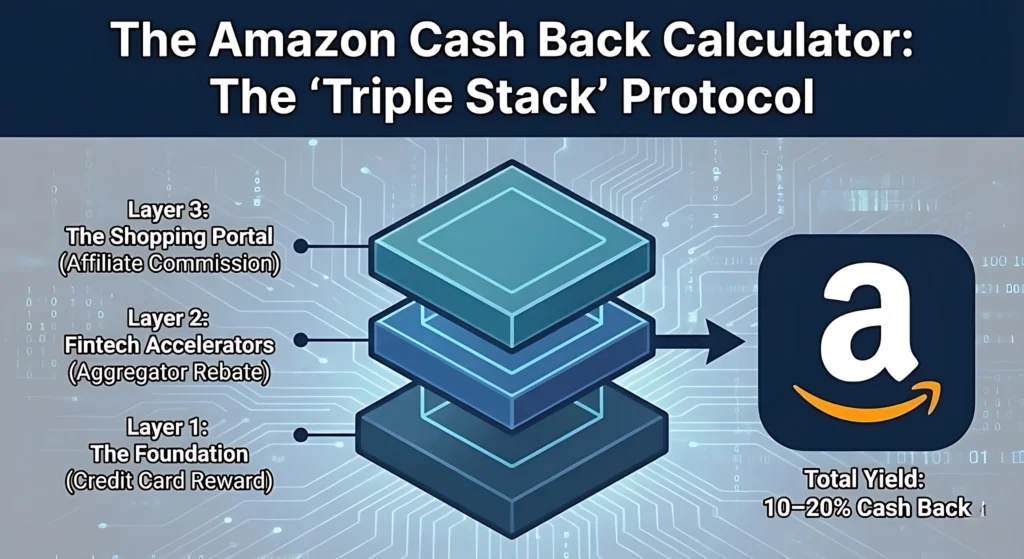

According to a comprehensive analysis of the 2025 financial landscape, 5% is merely the baseline. By utilizing the “Triple Stack” Protocol—a method of layering bank incentives, fintech rebates, and affiliate commissions—you can consistently achieve returns between 10% and 20%.

This is not a glitch; it is Financial Arbitrage. It works by decoupling your payment method from your purchase method. Here is how the “Amazon Cash Back Calculator” works.

The Formula: How the Math Works

The theoretical yield of any Amazon transaction is modeled by this equation:

Amazon Cash Back Calculator

Layer 1: The Foundation (The Capital Source)

The biggest mistake shoppers make is paying Amazon directly. When you pay Amazon directly, you are limited to “Online Shopping” rewards. To unlock higher tiers, you must disguise your Amazon spend as a high-yield category, such as Grocery or Office Supply.

Strategy A: The “Grocery Store Pivot”

This is the most potent strategy for families.

- The Mechanism: Visit a supermarket (e.g., Kroger, Whole Foods) and purchase physical Amazon Gift Cards.

- The Instrument: Use a card like the Amex Gold (4x points on groceries) or Blue Cash Preferred (6% cash back on groceries).

- The “Shadow” Return: Grocery chains often offer Fuel Points on gift card purchases.

- Example: 4x Fuel Points on a $500 gift card = 2,000 Fuel Points.

- Yield: This equals ~$2.00 off per gallon. On a 20-gallon tank, that is a $40 savings (an additional 8% return).

Strategy B: The “Office Supply Arbitrage”

- The Mechanism: Buy Amazon Gift Cards at Staples or Office Depot.

- The Instrument: The Chase Ink Business Cash® offers 5% cash back (or 5x Ultimate Rewards) on office supply stores.

- Why use this? If you hold a premium Chase card, these points can be transferred to travel partners, effectively valuing your return at 7.5% – 10%.

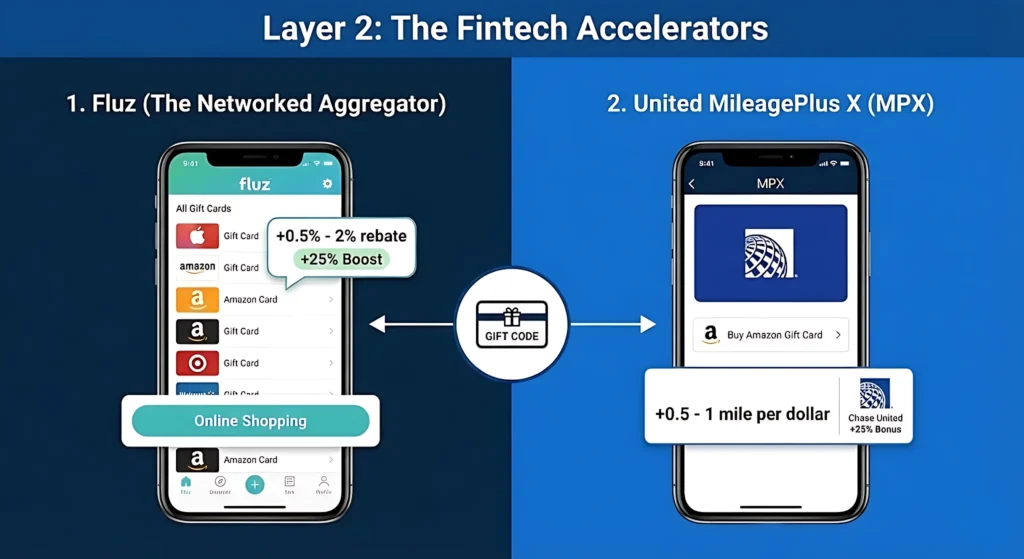

Layer 2: The Fintech Accelerators (The Stack Generator)

If you prefer digital shopping over physical stores, you use “Layer 2.” Instead of paying Amazon, you pay a middleman app that rewards you for buying a digital gift card code.

1. Fluz (The Networked Aggregator)

Fluz sells gift card codes instantly.

- The Strategy: Link a card set to “Online Shopping” (like the Bank of America Customized Cash Rewards).

- The Reward: You get your credit card points (3% – 5.25%) PLUS the Fluz rebate (0.5% – 2%) PLUS any “Boosts” (promotional rates up to 25% for new users).

2. United MileagePlus X (MPX)

- The Strategy: Buy an Amazon gift card through the MPX app.

- The Reward: You earn United Airlines miles instantly (0.5 – 1 mile per dollar).

- The Bonus: Chase United cardholders get a 25% bonus on these miles. This allows you to stack airline miles on top of your credit card points.

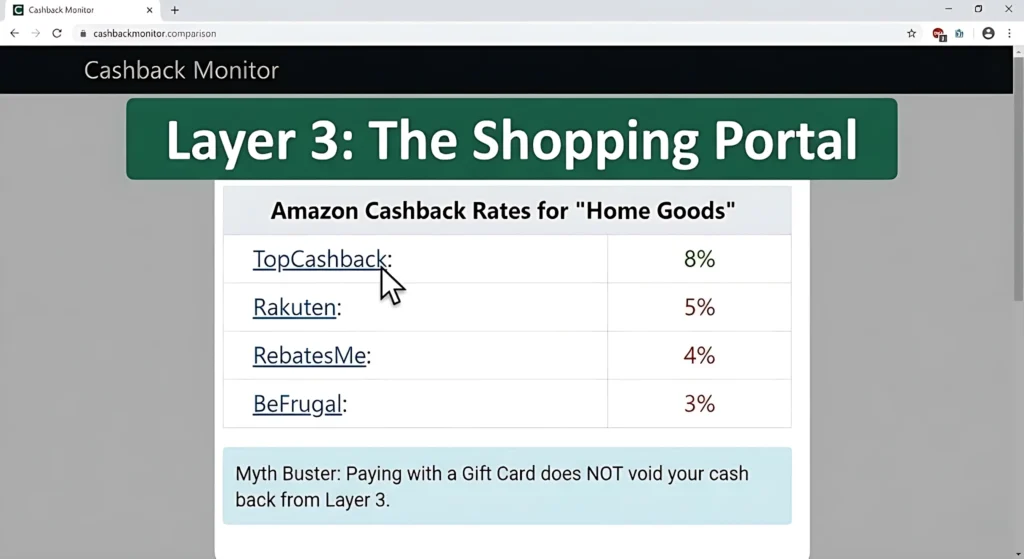

Layer 3: The Shopping Portal (The Commission)

This is the final step before you buy. Affiliate portals (like Rakuten or TopCashback) get paid a commission by Amazon to send you there. They share that commission with you.

The “Empty Cart” Protocol

Attribution is fragile. To ensure you get paid, you must follow this strict sequence:

- Clear your Amazon Cart.

- Close all Amazon tabs.

- Open the Portal (e.g., TopCashback).

- Click the Amazon link.

- Add items and Checkout immediately.

Myth Buster: Paying with a Gift Card (from Layer 1 or 2) does NOT void your cash back from Layer 3. Portal terms explicitly state that cash back is eligible when using gift cards as a payment method.

The Essential Tool: Cashback Monitor

Do not guess which portal to use. Visit Cashback Monitor. It aggregates data from 46+ portals to show you who is paying the most for your specific category (e.g., “Amazon Devices” might be 8% on TopCashback, while “Clothing” is 5% on Rakuten).

Amazon Customer Retention Strategy: How the World’s Most Loyal Brand Uses AI to Keep Customers Coming Back

Amazon Customer Retention Strategy uses AI and data to boost loyalty, personalize experiences, and keep customers coming back.

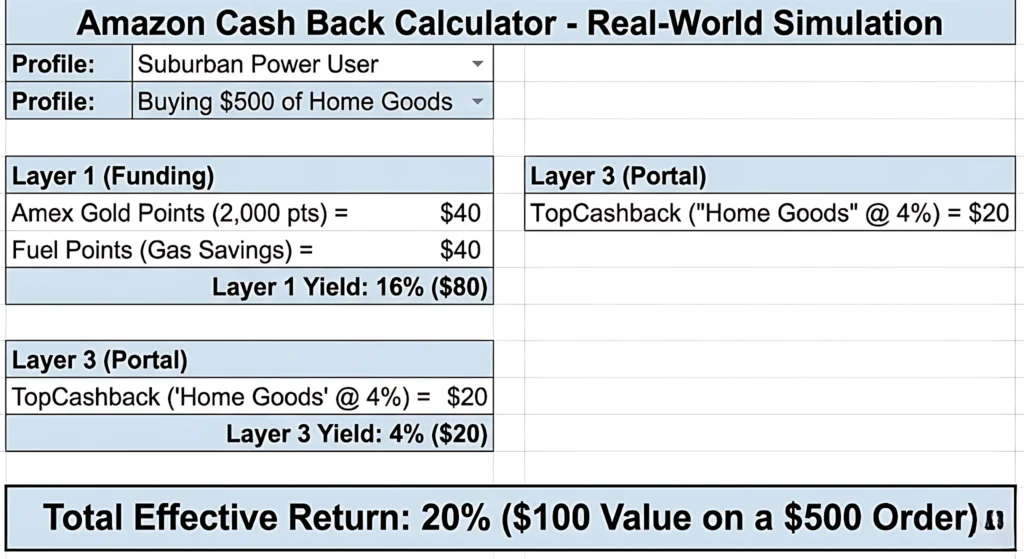

Real-World Simulation: The “Suburban Power User”

Let’s plug a real scenario into the Calculator to see the result.

Profile: Buying $500 of Home Goods.

- Layer 1 (Funding): Buys $500 Amazon GC at Kroger using Amex Gold.

- Result: 2,000 Amex Points (Valued at $40) + Fuel Points (Valued at $40 in gas savings).

- Yield: 16%

- Layer 2: (Skipped in favor of physical grocery trip).

- Layer 3 (Portal): Clicks through TopCashback for “Home Goods” (4% offer).

- Result: $20 Cash Back.

- Yield: 4%

Total Calculator Result: 20% Effective Return ($100 Value on a $500 Order).

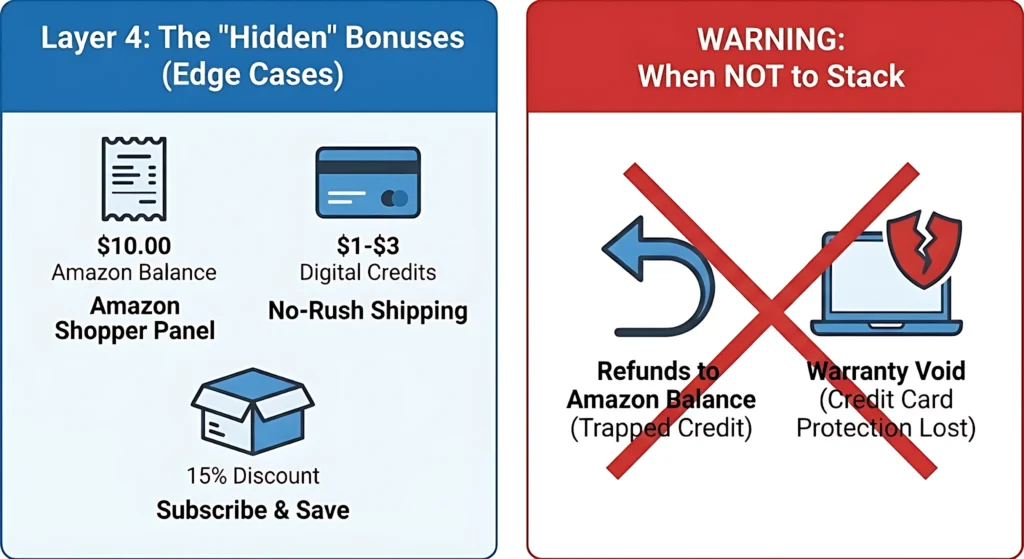

Layer 4: The “Hidden” Bonuses (Edge Cases)

To truly maximize the equation (Ytotal), consider these final optimizations:

- Amazon Shopper Panel: An invite-only app where you upload 10 receipts from other stores per month to earn $10.00 in Amazon Balance.

- No-Rush Shipping: If you don’t need the item tomorrow, select “No-Rush” to earn $1-$3 in digital credits (Movies/eBooks). On small orders, this can represent a 7-10% return.

- Subscribe & Save: Unlocking the 5-item tier grants a 15% discount off the invoice price. This stacks on top of your Gift Card funding method.

WARNING: When NOT to Stack

The Triple Stack requires purchasing Gift Cards, which creates specific risks. Do NOT use this calculator if:

- You might return the item: Refunds go back to your Amazon Balance, not your credit card. You will be “trapped” with store credit.

- You are buying expensive electronics: Paying with a Gift Card usually voids credit card Extended Warranty and Purchase Protection benefits. If you are buying a MacBook, the 5% loss in rewards is worth the safety of the warranty.

Conclusion

The “Amazon Cash Back Calculator” proves that the price you see on the screen is rarely the final price you pay. By decoupling the payment (Layers 1 & 2) from the purchase (Layer 3), you move from being a consumer to a financial optimizer.

Your Next Step: Before your next order, do not just click “Buy Now.” Check Cashback Monitor, grab a Gift Card, and stack your way to a 15% return.

Muhammad Talha breaks down complex AI tools into simple, step-by-step guides for e-commerce entrepreneurs. His goal: to help you work smarter, not harder, by leveraging artificial intelligence